Blog

Blog

Ecuador has increased its PIG production in the last 15 years

06th May 2025 - News

Advances in production, efficiency, and consumption have positioned the Ecuadorian pig sector as a key pillar within the country’s agricultural and livestock industry, contributing significantly to its economy. Currently, its activity represents about 8% of the agricultural GDP, generates an annual income of approximately 600 million dollars, and generates around 80,000 direct jobs and more than 200,000 indirect jobs.

15 years of growth

Ecuador’s pig sector has experienced sustained growth over the last 15 years. Thus, in 2010, the country produced around 95,000 tonnes of pork; the figure rose to 222,000 tonnes in 2024, representing an increase of 134% and an annual average of 6.3%. This growth has been possible thanks to investment in technology, improved pig genetics, strengthened farm biosecurity, and optimised feeding systems.

Currently, the national pig inventory is estimated at 2.8 million, of which 129,000 are breeding sows. Of these, 61% belong to backyard production systems, while 39% correspond to technified systems. On the other hand, in Ecuador, there are 166,000 pig producers, and more than 94% of them are small producers. However, the five leading companies in the sector account for almost 40% of the country’s total breeding stock.

Despite the strong presence of small producers, the Ecuadorian pig sector is undergoing a process of formalisation, thanks to the training of its professionals and investments in new technologies that improve farm productivity and profitability.

Production efficiency

From a productive point of view, Ecuador stands out for its efficiency. According to data from Agriness, the country has reached a farrowing rate of 84.14%, with an average of 14.06 piglets born per litter, 2.34 births per sow per year and 27.94 weaned piglets per sow per year. These indicators place Ecuador at a competitive level against Colombia, Argentina and Paraguay. Improvements in genetics have been key to these advances and have led to improved feed conversion efficiency and reduced fattening time of animals.

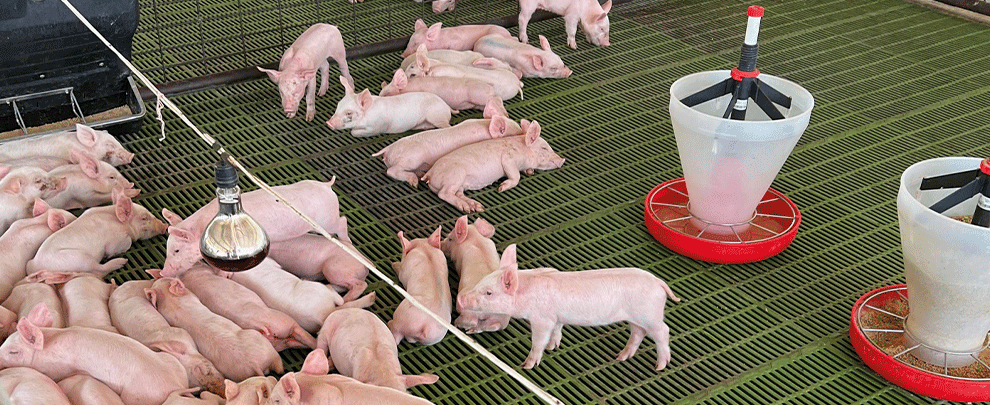

Image of a gestation barn in Ecuador. Photo: Porkagro.

Market

Thanks to the growth in pig production, Ecuador has achieved high self-sufficiency in meeting the domestic demand for this food. In the last 10 years, imports have been reduced by 70%. Currently, around 230,000 tonnes of apparent consumption is 97% covered by national production, and only 3% comes from imports.

The country has taken the necessary steps in terms of exports. In 2023, it entered the Ivorian market, exporting 22.5 tons of pork. In addition, in 2024, thanks to the joint work between its private companies and public institutions, Ecuador established trade relations with Vietnam and exported 27 tons of product. These advances represent the beginning of an internationalisation strategy that seeks to expand into new markets, with the Asian market being one of the main goals, specifically China and South Korea.

Consumption

The increase in pig production has been accompanied by an increase in per capita consumption of pork in Ecuador. In this way, it is estimated that in 2024, each Ecuadorian will consume an average of 12 kg of pork per year, about four kilos more than five years ago. This data reflects a change in consumption habits, even with chicken meat at the forefront, and a greater acceptance of this protein within their diets. Among the different reasons that have driven the increase in consumption is the improvement in the quality of the product, the various campaigns to promote pork consumption, the diversification of the supply and the incorporation of new cuts that have contributed to strengthening demand in the domestic market.

Prospects

With the strengthening of technified production, the consolidation of the domestic market and the opening to international markets, the Ecuadorian pig sector is positioned as an industry with great potential for development and growth in the coming years. In this regard, national production is expected to reach 280,000 tonnes of pork in 2030, representing an increase of 25% compared to 2024. This growth would be accompanied by greater domestic demand and export opportunities. Considering all of the above, the development of processing infrastructure, access to sustainable technologies, and adaptation to consumer trends will be key to guaranteeing the sector’s medium- and long-term competitiveness.

Source: 3tres3.