Blog

Blog

Italy’s swine sector: An economic engine

29th October 2025 - News

Italy has one of Europe’s most powerful and diversified food industries, and swine ranks prominently not only for its economic and social weight but also for its deep cultural roots. Despite this strong position, the sector faces significant structural, sanitary, and market challenges that will shape its future.

Size and structure of the Italian pig sector

Italy has roughly 8.7 million pigs, including more than 617,000 breeding sows, distributed across approximately 26,000 farms. The production structure combines small family holdings with larger commercial operations, with an average of about 321 animals per farm.

The sector employs around 50,000 people directly. The rearing and processing of pigs generates more than €8 billion annually. Including the value added by processed products, especially PDO hams, the chain is worth more than €20 billion, consolidating swine as one of the country’s economic engines.

Production, imports and trade relations

Despite its strong processing capacity, domestic production does not cover internal consumption or the needs of the export industry. Between 2019 and 2023, pig production fell by 16.5%, reaching 1.24 million tonnes in 2024. This decline forced high levels of imports. In 2024, Italy imported over 1.02 million tonnes of pork, valued at €3,071 million, at an average price of €2.98/kg. The leading suppliers were Germany (27.4%), Spain (26.5%), and the Netherlands (15.7%). In addition, Italy imported 1.4 million live pigs, mainly from Denmark, Germany, and the Netherlands.

Spain has consolidated its role as one of Italy’s leading suppliers, exporting 273,000 tonnes in 2023 worth more than €800 million. However, these exports focus on basic products (frozen meat and offal), posing the challenge of diversifying toward higher value‑added products, such as processed meats, in a competitive market with a strong local identity.

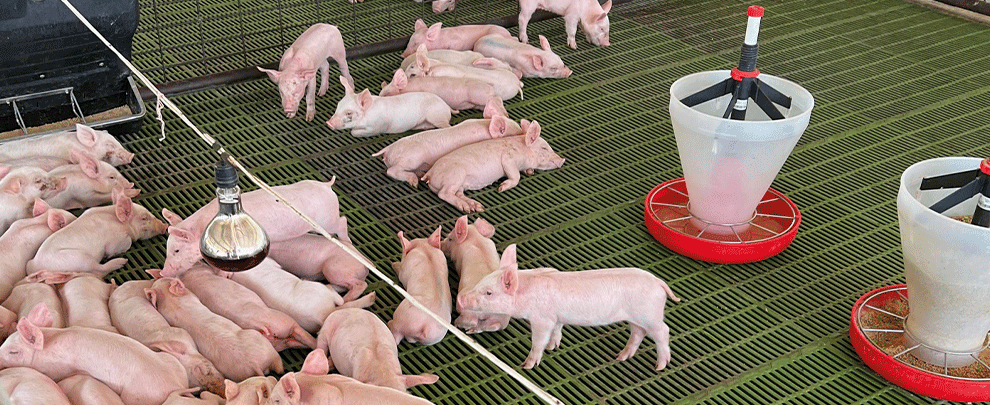

Image of an italian fattening farm. Photo: Rotecna.

Pork consumption in Italy

Meat consumption in Italy stands at 75–80 kg per person per year, of which about 47 kg is pork, evidence that pork remains the nation’s most consumed animal protein. As elsewhere in Europe, overall meat consumption is showing signs of slowdown, particularly among younger, urban segments.

Increasingly, Italian consumers opt for local products, quality seals, organic options, or items associated with a healthy lifestyle. In this context, cured and cooked hams and PDO sausages continue to gain prominence. This is not just a shift in shopping habits; it is an opportunity for swine to reinforce its place within the Mediterranean diet by aligning with values, sustainability, animal welfare, and health, that guide consumers today.

Impact of African Swine Fever (ASF) in Italy

A significant challenge in recent years has been African swine fever (ASF). Initial cases were detected in 2022 among wild boar and domestic pigs in key regions such as Liguria, Piedmont, Emilia‑Romagna, Calabria, and Lombardy. The virus’s rapid spread led to the culling of thousands of animals and strict restrictions that severely affected movement, marketing, and international trade, including export suspensions to third countries such as Canada, Mexico, and China.

Containing the disease became a national priority. Italy reinforced wildlife control, isolated affected areas, and increased investment in biosecurity. As a result, in January 2025, the Ministry of Health announced ASF had been eradicated in Rome, following approval by the EU’s Standing Committee on Plants, Animals, Food and Feed to lift restricted zones. This achievement, thanks to institutional coordination, cooperation with the hunting sector, and commitment from local authorities, marks a crucial step toward recovery. Even so, authorities stress the need for high vigilance to prevent flare-ups and to maintain sanitary security.

Future challenges for the Italian pig sector

Italy’s swine sector faces a set of interrelated challenges affecting its productive structure and market position. First, animal health and biosecurity must be reinforced, especially given the constant threat of ASF and other emerging diseases. At the same time, the sector must reduce its heavy reliance on imports through policies that support farm modernisation, generational renewal, and growth in domestic production.

The market also demands change. The sector must aim for innovation and differentiation, promoting higher value‑added products that are more sustainable and aligned with current consumer preferences. Traditional charcuterie can play a leading role, but it must integrate elements such as animal welfare, traceability, environmental efficiency, and a smaller climate footprint.

Internationally, the sector must strengthen export capacity, diversify markets, and adapt to new sanitary and trade regulations, all in a context of growing global competition and social pressure on livestock models. The future of Italian swine will depend on its ability to combine tradition, quality, and sustainability with a long‑term strategic vision.

Source: Interpoc.