Blog

Blog

South Korea: Key pork importer and consumer in swine industry

03 of March of 23 - News

South Korea stands out for being one of the countries in the world with the highest domestic demand for pork. Despite this, the South Korean pork industry is developing towards an efficient and modernised sector, while, little by little, new farms appear. To cope with its high demand, the South Korean pork sector relies on imports and is currently one of the world’s largest raw and processed pork importers, importing around half a million tons a year.

Structure of the South Korean pork sector

Changes in the livestock sector and emerging diseases have had a lot to do with defining the structure of South Korea’s pork sector. Falling wholesale pork prices prompted South Korean farmers to reduce their pig register, from 11.33 million in 2010, to 11.28 million in 2020.

On the other hand, the number of pork producers and pig farms has also experienced a sharp decline in recent years. According to 2020 data, there are about 5,000 farms in South Korea, a lower figure than the 8,000 in 2009, and far from the 24,000 that the country had in 2000. In this sense, the South Korean pork sector is in a transformation phase in which small low-tech farms are disappearing while significant investments are made for the construction of new facilities.

Consumption

It is estimated that, in recent years, pork consumption in South Korea per capita has been around 27kg. However, in 2020 it was slightly lower because of the strong social distancing measures imposed by the South Korean government due to the Covid-19 pandemic. These restrictions affected restaurants (which comprise a large part of the consumption) and schools, where there was a sudden decrease in consumption. On the other hand, the demand for pork to consume at home increased in that period, consolidating this food as the preferred option of South Koreans when it comes to consuming meat at home.

Commerce

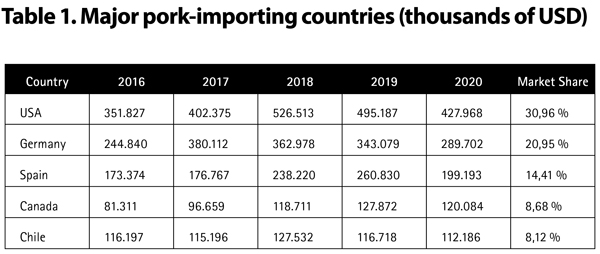

The high consumption of pork in South Korea has led the country to depend on pork imports to meet domestic demand. In 2020, the Asian country imported pork worth a total of 1,382 million USD, a figure somewhat lower than in previous years due to the reduction in consumption due to the restrictions of the pandemic. Its main suppliers were the United States, Germany, Spain, Canada and Chile (Table 1).

As we have seen, Spain is listed as the third largest supplier of pork to South Korea. In 2020, it exported 54,255 tons to the Asian country, worth approximately 192 million euros. The vast majority of Spanish exports to South Korea (98%) correspond to frozen meats and offal, while the rest are bacon and processed product exports, which coincides with the nature of pork imports from the South Korean market, which consist of frozen meats, offal and bacon.

It is worth mentioning that between 2013 and 2018, Spanish pork exports to South Korea grew uninterruptedly. However, in 2019, and, above all, in 2020, with the pandemic, they regressed significantly, starting a recovery in 2021.

Future forecasting

The South Korean pork market brings together different strategic elements of great interest. Due to its size, it is a market with around 52 million inhabitants with a high purchasing power correlated with its high standard of living. In addition, pork is the main source of animal protein for South Korean consumers after fish, being one of the markets with the highest consumption of pork worldwide per capita. For this reason, South Korean pork imports are expected to continue to increase in the coming years, reaching 450,000 tons by 2030. On the other hand, the number of pigs is expected to increase as the wholesale price does.