Blog

Blog

Canada is established as a pork producer-exporter

21st November 2023 - News

Thanks to a very modern, technified and competitive pork production structure, Canada has positioned itself as the ninth world producer of pork and the third exporter. In this sense, it is a producer-export market, largely dependent on its exports, which reach 71% of its production. The country also has a high consumption rate.

Size and structure of the industry

Currently, Canada has around 7,500 highly professionalised pig farms, which house about 14.2 million pigs, nearly half that in Spain, according to data from the Ministry of Agriculture, Fisheries and Food. With these numbers, the average size is approximately 1,800 pigs per farm. If we compare this data with the Canadian population (around 38 million inhabitants), we face a market with a marked producer and exporter character and highly dependent on its exports.

Production

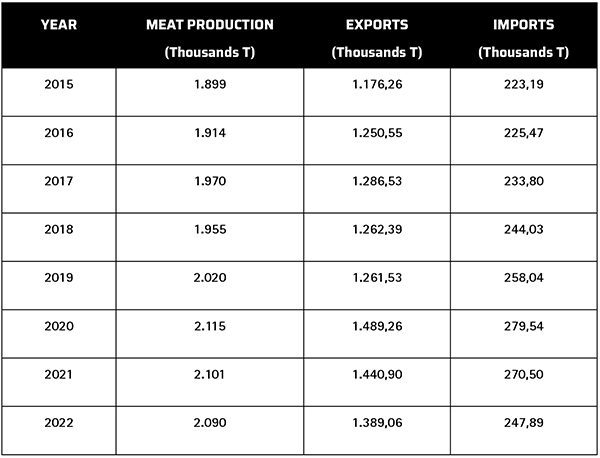

Canada is the ninth largest pork producer worldwide, accounting for 1.97% of the total. Since 2017, the growth of its production has reached 5.1% (Figure 1). This has been possible thanks to the good practices adopted regarding animal handling, sustainability and welfare. In addition, biosecurity has also been a priority for Canadian farmers, who have adapted their farms with the most advanced technologies in this regard.

Table 1. Balance of pork production - export - import in Canada.

The area with the highest production is the province of Quebec, far ahead of the rest. It is followed by Ontario and Manitoba. By contrast, the area of the country where less pork is produced is the region of Nova Scotia.

Consumption

Pork consumption in Canada, which has always been relatively high, has increased slightly over the last few years and in 2022 reached 25 kilos per capita per year. Pork is considered by Canadians to be a versatile and tasty option and is consumed in the form of fresh cuts, processed products and cold cuts. It is worth mentioning that, due to its French gastronomic background, charcuterie is firmly rooted in the country, and 50% of pork consumption is made in the form of processed products.

On the other hand, in 2021, pork sales reached 706,000 tons, 2.6% more than in 2017. This amount represents 25% of all meat categories, which amounts to 2,808 thousand tons.

Meat market

The long tradition of exporting pork in Canada has positioned the country as the third largest exporter worldwide, behind the European Union and the United States. According to ICEX data for 2021, Canada exported pork worth 4,180 million (Canadian dollars), while, in thousands of tons, its exports reached 1,465. The countries where Canada exports the most pork are China, the United States, Japan and Mexico. According to data from Canada Pork, 71% of Canadian meat production is exported.

Regarding meat imported from Canada, the high consumption of charcuterie and sausages is reflected in pork imports. In 2022, 38% in volume and 57% in value of pork imports corresponded to processed meats (sausages, preserves, cured hams, bacon, etc.). Its leading suppliers are the United States, Denmark, Germany, Italy, Austria and Spain.

In 2022, Spain was Canada’s fourth largest pork supplier, behind only the United States, Germany and Denmark. Spanish exports accounted for 2.56% of Canadian pork imports, mostly frozen meat and offal.

Challenges of the pork sector

As we have seen, Canada has a modern and technified pork sector. Maintaining this status is one of the main challenges the industry faces, which tries to maintain high standards of biosecurity and animal health to prevent the spread of diseases. In this sense, Canadian farms must be committed to implementing strict measures to guarantee the health of pigs and avoid the appearance of diseases.

Finally, the role of Canadian pork at the global level should be considered since, as global demand for pork increases, competition between the main producing countries becomes more evident. In this sense, the Canadian pork industry must continuously work on efficiency, quality and product diversification issues to maintain its position worldwide.